Go Stabilize. Go Invest. Go Grow.

Tongo is a commission-backed line of credit that offers access to the capital you need to grow your business, and only repay when you get paid. It’s private and costs as low as 3% per 30 days.

Proudly partnered with:

What is Tongo?

Tongo is a line of credit built for real estate agents.

The first commission-backed line of credit.

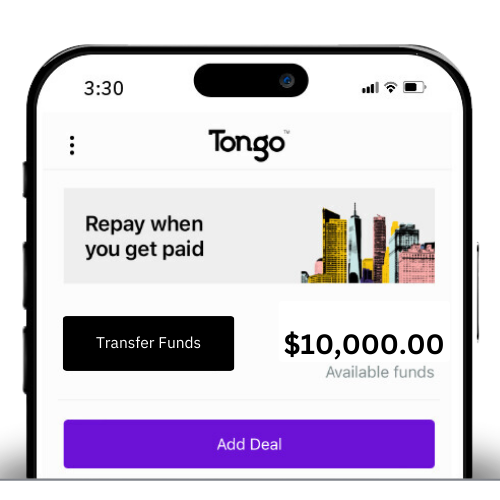

It’s a line of credit based on your pending commissions. Agents add pending deals in Tongo to open their available limit. That limit can be accessed as needed by instantly transferring funds to a linked bank account or by swiping the Tongo card.

We work the way you do.

Use your approved limit to invest in your business. Then when a deal closes and you’ve received your commission, repay Tongo directly. With Tongo, your expenses and income are aligned so you can focus on growth.

How it Works

Stabilize, invest, and grow in 3 easy steps.

Join

Sign up takes less than a minute. Then simply tell us about your pending deals to build an available limit. Limits are based on pending commissions, production, and payment history. Upload multiple deals to build a higher limit.

Spend

Use your approved line of credit by instantly transferring funds to your checking account or by making purchases with the Tongo card. Either way fees are as low as 3% per 30 days. Come back to your line of credit as many times as needed before a deal closes.

Repay

Tongo gets paid when you get paid. When your deal closes and you receive your commission, your Tongo balance for that deal is due in full. Fees are charged on the amount of the line of credit used. If you don’t use any of your credit line, there’s nothing to pay.

Tongo Reviews

Here's what Tongo members have to say:

I'm so happy with my experience so far with Tongo. Accessing commissions early and easily is crucial, especially when deal flow is down. Every single person I've spoken to at Tongo is incredibly personable, offering a service that feels more like private banking. For those of us at Douglas Elliman, it’s incredibly convenient, being integrated with our app.

Cat Serra-Garcia, Douglas Elliman

I use Tongo to pay certain business expenses that are scattered throughout the year, particularly when funds aren't immediately available. With Tongo, I always have access to my commission, regardless of any delays I might be facing on my side.

Ryan Siciliano, Douglas Elliman

Tongo has been a game-changer for me in the real estate business. What I adore most is their top-notch customer service—super prompt and always ready to help. Plus, the fees are incredibly competitive! I've already sung Tongo's praises to other agents. It's transformed the way I handle commissions.

Kimberly Vetter, RE/MAX

FAQs

-

Your Tongo balance is due in full when your deal is closed. If a deal closing is delayed, the due date adjusts accordingly. If a deal falls through, your next deal will be your replacement deal, and the Tongo balance is paid in full when your replacement deal closes.

-

Residential sales transactions that are scheduled to close within 60 days are eligible for a Tongo commission-backed line of credit. Residential leases are also eligible for a Tongo commission-backed line of credit.

-

When you apply for Tongo, we may perform a soft credit inquiry which has no impact on your credit score.

Unlike hard credit inquiries, soft credit inquiries, also known as soft credit pulls or soft credit checks, are reviews of your credit report that do not affect your credit score.

-

We value your privacy. Your broker does not need to sign off for you to use Tongo.

-

The Tongo card lets you conveniently make purchases with your approved line of credit limit anywhere Visa is accepted. You’re not required to use it and can always simply transfer funds instantly to a linked bank account.

-

Tongo is not a loan or a credit product. A commission-backed line of credit is Tongo purchasing a future commission with the promise of repayment for a reasonable fee. Factoring can help businesses improve their short-term cash needs by selling their receivables in return for an injection of cash from the factoring company.